Discover how the SEC’s new climate disclosure rules are impacting CRE, plus more industry insights in this week’s Core Texts.

1. The SEC Unveils New Climate Disclosure Rules 🏛

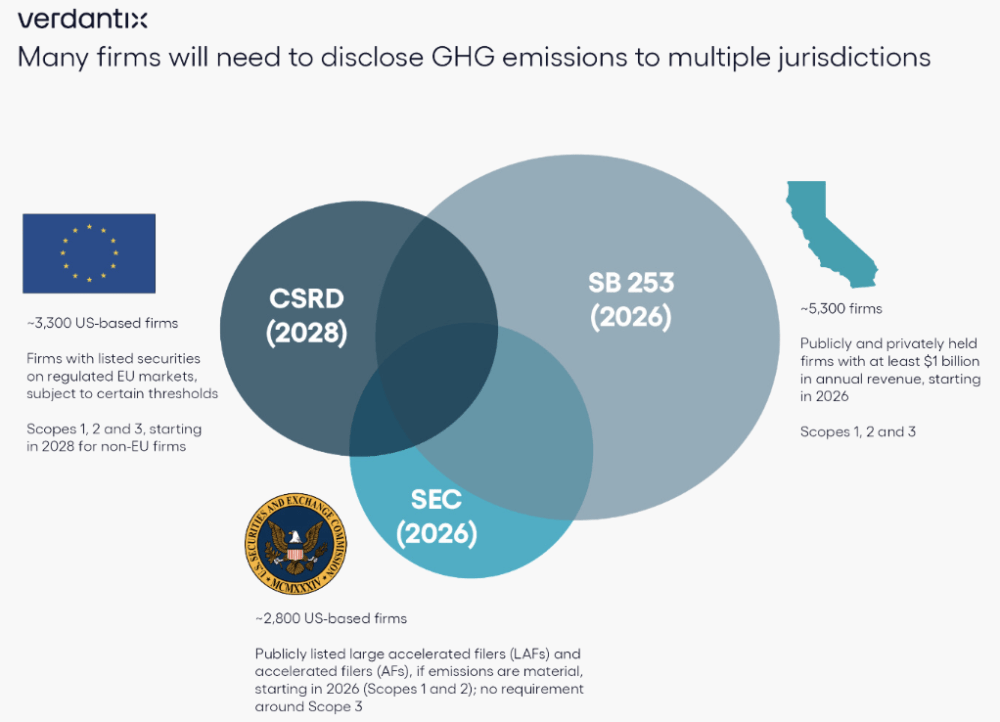

💡 What you need to know: Last week, the Securities and Exchange Commission (SEC) introduced new rules that mandate public companies to disclose climate-related risks and greenhouse gas emissions. This regulatory shift, influenced heavily by institutional investors’ demand for transparency, represents a balance between comprehensive climate disclosure and the practical challenges companies face in reporting. A notable 88 percent of institutional investors reportedly favor companies that offer a combined report of their financial and ESG activities. Although the finalized rules are less comprehensive than initially proposed – particularly the exclusion of Scope 3 emissions, which account for indirect emissions in a company’s value chain – they mark a significant step towards addressing the demand for greater transparency in climate-related reporting.

⚡ Why it’s important: ️The reduced scope of mandated disclosures reflects the SEC’s attempt to accommodate companies’ concerns about the burdens of extensive reporting requirements while responding to investor demands for reliable and useful information on climate risks. Between the new SEC rules, CSRD, and SB 253, both firms and investors will continue to face a cumbersome process to report and interpret corporate climate risks across various jurisdictions. 😕

While SEC oversight will provide greater visibility into each company’s climate exposure and impact, its effectiveness still relies on some measure of subjectivity, particularly in how companies define and report ‘material’ risks. This vagueness may pose a challenge to institutional investors who have shown a clear preference for detailed ESG information. Advocacy for the inclusion of Scope 3 emissions is sure to continue. There’s little doubt that climate disclosure standards will remain a critical area of debate, as they increasingly underpin corporate strategy and investment decision-making in a progressively more climate-conscious world.

We invite you to familiarize yourself with the SEC’s implementation timeline so that you can prepare. Then, get the full rundown on today’s Building Performance Standards (BPS), including coverage of New York City’s LL97 – which has just entered its first compliance period – and Boston’s BERDO.

2. Assessing the New SEC Rules’ Impact on CRE 🏢

💡 What you need to know: The SEC’s new climate disclosure rules present a significant shift for the commercial real estate (CRE) sector, emphasizing the need for transparency in reporting direct emissions (Scope 1) and those from purchased energy (Scope 2). While the omission of Scope 3 emissions reduces the burden of reporting indirect emissions across supply chains, CRE firms – especially REITs and other large entities – must navigate a complex and potentially costly regulatory landscape. For CRE companies, the ability to accurately collect, analyze, and report emissions data is more critical than ever to compliance, in addition to meeting the growing expectations of tenants and investors focused on sustainability. 🍃

⚡ Why it’s important: In this new context, digitizing building processes through the deployment of a smart, energy insight platform like Cortex has become a prerequisite to compliance and market competitiveness. Building digitization enables firms to confidently navigate reporting hurdles and avoid fines by actively charting and documenting energy usage across their entire portfolios over time. Energy insight platforms also put real-time data in the hands of their operating teams so that they can make more efficient, informed decisions to limit energy usage, save money, and reduce emissions. As compliance becomes more complex and emissions data more public, firms must embrace digital solutions to meet evolving regulatory and market expectations.

More news and notes 📌

🏦 RXR argued that CRE’s debt problem hasn’t been adequately addressed.

😐 Fed. Chair Jerome Powell described CRE’s banking risk as ‘manageable.’

📈 BLS noted that US electricity prices have outpaced annual inflation.

🔄 Boston’s new office-to-residential conversion program saw its first results.

💸 GlobeSt found that February inflation eclipsed the WSJ’s median forecast.

🗄 CompStak reported that rents for prime NYC office space have plateaued.

Cut through the noise

Subscribe to Core Texts, our weekly newsletter, and get a round up of today’s CRE, Tech and sustainability news delivered to straight to your inbox.